The Project Gutenberg EBook of Railroad Reorganization, by Stuart Daggett This eBook is for the use of anyone anywhere in the United States and most other parts of the world at no cost and with almost no restrictions whatsoever. You may copy it, give it away or re-use it under the terms of the Project Gutenberg License included with this eBook or online at www.gutenberg.org. If you are not located in the United States, you'll have to check the laws of the country where you are located before using this ebook. Title: Railroad Reorganization Author: Stuart Daggett Release Date: August 21, 2017 [EBook #55397] Language: English Character set encoding: UTF-8 *** START OF THIS PROJECT GUTENBERG EBOOK RAILROAD REORGANIZATION *** Produced by WebRover, MWS, Adrian Mastronardi, Charlie Howard, the Philatelic Digital Library Project at http://www.tpdlp.net and the Online Distributed Proofreading Team at http://www.pgdp.net (This file was produced from images generously made available by The Internet Archive/American Libraries.)

Transcriber’s Note

Cover created by Transcriber and placed in the Public Domain.

HARVARD ECONOMIC STUDIES

Volume I: The English Patents of Monopoly, by William H. Price. 8vo, $1.50, net. Postage 17 cents.

Volume II: The Lodging-House Problem in Boston, by Albert B. Wolfe. 8vo, $1.50, net. Postage 17 cents.

Volume III: The Stannaries; A study of the English Tin Miner, by George R. Lewis. 8vo, $1.50, net. Postage 17 cents.

Volume IV: Railroad Reorganization, by Stuart Daggett. 8vo, $2.00, net. Postage 17 cents.

Volume V: Wool-Growing and the Tariff, by Chester W. Wright. 8vo, $2.00, net. Postage 17 cents.

Volume VI: Public Ownership of Telephones on the Continent of Europe, by Arthur N. Holcombe. 8vo, $2.00, net. Postage 17 cents.

Volume VII: The History of the British Post Office, by J. C. Hemmeon. 8vo, $2.00, net. Postage 17 cents.

Volume VIII: The Cotton Manufacturing Industry of the United States, by M. T. Copeland. 8vo, $2.00, net. Postage 17 cents.

HARVARD UNIVERSITY

Cambridge, Mass., U.S.A.

HARVARD ECONOMIC STUDIES

PUBLISHED UNDER THE DIRECTION OF

THE DEPARTMENT OF ECONOMICS

VOL. IV

BY

STUART DAGGETT, Ph.D.

INSTRUCTOR IN ECONOMICS IN HARVARD UNIVERSITY

BOSTON AND NEW YORK

HOUGHTON, MIFFLIN AND COMPANY

The Riverside Press, Cambridge

1908

COPYRIGHT 1908 BY THE PRESIDENT AND FELLOWS OF HARVARD COLLEGE

ALL RIGHTS RESERVED

Published May 1908

It sometimes happens that experiences long since past seem to be repeated, and that knowledge apparently forgotten proves again of service. This is illustrated by the subject of railroad reorganization. In the years between 1893 and 1899 an imposing group of American railroads passed into receivers’ hands. In 1893 alone more than 27,000 miles, with an aggregate capitalization of almost $2,000,000,000, were taken over by the courts, and in the following years the amount was largely increased. Foreclosure sales aggregated 10,446 miles in 1895, 12,355 in 1896, and 40,503 between 1894 and 1898. Among the more important failures were those of the Richmond & West Point Terminal, the Reading, the Erie, the Northern Pacific, the Atchison, and the Baltimore & Ohio;—to say nothing of the Norfolk & Western, the Louisville, New Albany & Chicago, the Ann Arbor, the Seattle, Lake Shore & Eastern, the Pecos Valley, and many other smaller lines.

The railroads which failed between 1893 and 1898 were subsequently reorganized. In order to restore the equilibrium between income and outgo the companies turned to their creditors, and demanded the surrender of a part of the rights of which bondholders were then possessed. This demand the creditors were forced to concede. Some of them yielded without legal compulsion, assenting to “voluntary reorganizations”; some insisted upon the sale of the property securing their loans, but without escaping the loss which fell upon their more pliant associates. Much injustice to individuals came to light at this time. Men who had invested in good faith were obliged to sacrifice their holdings through no fault of their own. The savings of years were swept away. The demand of the railroads was one, nevertheless, which the courts supported, and rightly. The companies could not be operated unless the creditors were deprived of part of their legal rights. At the same time, these rights no longer had a material basis on which to rest, and their surrender meant but the recognition of a loss which had already taken place.

Most of the reorganizations were completed by the year 1899. Since that date the improvement in railroad earnings has been marvellous.vi Gross earnings from operation were $1,300,000,000 in 1899, they were $2,300,000,000 in 1906, the last year for which the figures of the Interstate Commerce Commission are at present available. Total income, after the deduction of operating expenses, was $605,000,000 in 1899, and $1,046,000,000 in 1906. It is not to be wondered at that the distress of the years 1893–9 has not been duplicated during the years 1900–7. On the contrary, weak roads have had opportunity to strengthen their positions, and strong ones have spent enormous sums for improvements, and have declared liberal dividends besides. In no year save 1905 has the new mileage put into receivers’ hands been greater than 800 miles, and in but one has the mileage sold at foreclosure equalled that figure. Operating expenses have increased because the amount of business has exceeded the ability of the railroads to handle it. Equipment has been so inadequate as to provoke drastic legislation by the legislatures of many states; yards and terminals have been crowded until a prominent railroad officer has declared the expenditure of over five billion dollars to be necessary to restore the equilibrium between facilities and traffic.

These conditions have caused the earlier problems of failure and reorganization to be lost to view. Nevertheless, the financial panic of October, 1907, and the recession in activity which has become more and more apparent since that time, have again brought these problems forward. The Seaboard Air Line, one of the important railroad systems of the South, failed on January 5, 1908. The Chicago Great Western followed three days later. The Detroit, Toledo & Ironton, the Chicago, Cincinnati & Louisville, the International & Great Northern, the Western Maryland, and the Macon & Birmingham have since been put in receivers’ hands. In all, the operation of 5938 miles of railroad, with a capitalization of nearly $415,000,000, and total liabilities of $462,000,000, has been taken over by the courts during the first ten weeks of 1908. Whether this is but the beginning of still more extended trouble it is of course impossible to say. There are a number of weak lines in the American railroad system, and the difficulty in obtaining credit is bound to reveal weaknesses where they exist. At present new loans have for some months been difficult to obtain, and even strong railroads have resorted to the issue of short time notes. The Erie, indeed, escapedvii bankruptcy on April 8, 1908, only through the timely aid of important bankers who took up its maturing notes. This points to serious consequences for the weaker lines. It is true, on the other hand, that American railroads are generally in better financial and physical condition than they were in 1893. It is not probable that any railroad collapse will be so widespread now as it was then. Whether this be so or not, the failure of nearly 6000 miles of railroad in ten weeks invests reorganization problems at present with an importance which they have not had for ten years. How, it will be asked, shall the financial operations necessary to reorganization be performed? What methods shall be adopted, what dangers avoided, and what results expected?

The experience of earlier years will provide answers to many of the questions asked in 1908. In the hope, therefore, that a study of railroad reorganization, on which the author has been intermittently engaged during the last six years, will prove of service, the following pages have been published. They discuss in some detail the financial history of the seven most important railroads which failed from 1892–6, and that of one railroad, the Rock Island, which was reorganized in 1902; and summarize in a final chapter the characteristics of the various reorganizations in which these roads have become involved. In some respects the history of each road considered is peculiar unto itself. The Reading had coal to sell, the Atchison did not. The Southern ran through a sparsely settled country, the Baltimore & Ohio through a thickly settled one. The Erie has never recovered from the campaigns of Gould, Drew, and Fisk from 1864–72, the Northern Pacific was not opened until 1883. In other respects, however, the roads have had much in common. Excepting only the Rock Island, each of them has found itself at one time or another unable to pay its debts, and has had to seek measures of relief. The problems of the different companies at these times have been strikingly alike. However caused, their financial difficulties have been expressed in high fixed charges, and, usually, in excessive floating debts. Greater annual obligations have been assumed than the roads could meet, and current liabilities have accumulated while pressing demands have been satisfied. To this state of affairs the remedy has been sought in comprehensive exchanges of old securities for new. The exchanges, it is true, haveviii been carried out in different ways, and the collateral expedients employed have not been the same. To similar problems different solutions have been applied. It is possible, for this very reason, for a careful study of the alternative reorganization methods which have been developed to point out some policies which have been dangerous, and to make clear others which are both just, and likely to be successful. Such a study also throws light upon the history of the companies upon which it is based.

For the way in which the different roads have been handled, the reader is referred to the text. The order of treatment is very roughly determined by geographical location; that is, the Eastern roads are first considered, then the Southern, and then the Western. Each chapter, except the last, should be examined as a “case” in reorganization experience, and as part, therefore, of a united whole. No one has been so continuously with his work as the author himself, and no one can more keenly realize its defects. It is offered as a contribution in a field in which very little has as yet been done, and it is hoped that it will prove of value to those concerned with reorganization plans, as well as to those interested in the development of corporation finance during the last generation.

Without the unselfish and intelligent assistance of the writer’s Mother, the preparation of this book would have been long delayed. To her, first of all, thanks are due. To Professor William Z. Ripley, of Harvard University, should be made warm acknowledgment of his constant interest and helpful suggestions. To the Carnegie Institution the author is indebted for grants in aid of research in this special field. Grateful acknowledgment should also be made of gifts by friends of the University to cover the expenses of publication.

| CHAPTER I | ||

| Baltimore & Ohio | 1 | |

| Early history—Extension to Chicago—Trunk-line rate wars—Effect on the company—Extension to New York—Sale of bonds to pay off floating debt—Unsatisfactory traffic conditions—Receivership—Mr. Little’s report—Reorganization—Subsequent history. | ||

| CHAPTER II | ||

| Erie | 34 | |

| Early history—Reorganization—Wall Street struggles—Financial difficulties—Second reorganization—Development of coal business—Extension to Chicago—Grant & Ward—Financial readjustment—New York, Pennsylvania & Ohio—Third reorganization—Later history. | ||

| CHAPTER III | ||

| Philadelphia & Reading | 75 | |

| Early history—Purchase of coal lands—Funding of floating debt—Failure—Struggles between Gowen and his opponents—Reorganization—Second failure and reorganization. | ||

| CHAPTER IV | ||

| Philadelphia & Reading | 118 | |

| Difficulties of the Coal & Iron Company—McLeod’s policy of extension—Collapse of this policy—Failure of company—Summary of subsequent history. | ||

| CHAPTER V | ||

| The Southern | 146 | |

| Richmond & Danville—East Tennessee, Virginia & Georgia—Formation of the Southern Railway Security Company—Growth and combinations—Failure and reorganization of the East Tennessee—Reversal of position between the Richmond & Danville and the Richmond & West Point Terminal—Acquisition of the Central of Georgia—Failure and reorganization of the whole system—Subsequent development. | ||

| CHAPTER VI | ||

| Atchison, Topeka & Santa Fe | 192 | |

| Charter—Strategic extensions—Competitive extensions—Effect on finances—Raise in rate of dividend—Reorganization of 1889—Acquisition of the St. Louis & San Francisco and of the Colorado Midland—Income bond conversion—Receivership—English reorganization plan—Mr. Little’s report—Final reorganization plan—Sale—Subsequent history. | ||

| CHAPTER VIIx | ||

| Union Pacific | 220 | |

| Acts of 1862 and 1864—High cost of construction—Forced combination with the Kansas Pacific and the Denver Pacific—Unprofitable branches—Adams’s administration—Financial difficulties—Debt to the Government—Receivership and reorganization—Later history. | ||

| CHAPTER VIII | ||

| Northern Pacific | 263 | |

| Act of 1864—Failure and reorganization—Extension into the Northwest—Villard and the Oregon & Transcontinental Company—Lack of prosperity—Refunding mortgage—Lease of Wisconsin Central—Financial difficulties—Receivership—Legal complications—Reorganization—Subsequent history. | ||

| CHAPTER IX | ||

| Rock Island | 311 | |

| Charter—Early prosperity—Reorganization of 1880—Conservative policy—Extension—Pays dividends throughout the nineties—Moores obtain control—Reorganization of 1902—Further extensions—Impaired credit of the company. | ||

| CHAPTER X | ||

| Conclusion | 334 | |

| Definition of railroad reorganization—Causes of the financial difficulties of railroads—Unrestricted capitalization and unrestricted competition—Problem of cash requirements—Problem of fixed charges—Distribution of losses—Capitalization before and after—Value of securities before and after—Provision for future capital requirements—Voting trusts—Summary. | ||

Early history—Extension to Chicago—Trunk-line rate wars—Effect on the company—Extension to New York—Sale of bonds to pay off floating debt—Unsatisfactory traffic conditions—Receivership—Mr. Little’s report—Reorganization—Subsequent history.

The Baltimore & Ohio Railroad was the first important railway company to be incorporated in the United States. It was designed to aid the city of Baltimore in securing the Western trade, and not only private citizens but the city of Baltimore and the state of Maryland early subscribed to its stock. When in the course of construction it became expedient to extend into Virginia, the city of Wheeling and the state of Virginia likewise subscribed, though the action of the latter was subsequently withdrawn.1 As a result the funds required for first construction were obtained from the sale of stocks instead of bonds. In 1844, seventeen years after the granting of the charter, the annual report showed $7,000,000 in stock as against $985,000 in 6 per cent bonds; while in 1849, though the loans had been increased, they yet stood in the proportion of one to two.2

On December 1, 1831, the first train was run over the line, then 72½ miles in length.3 The early history of the road does not much concern us. It was one of steady growth, not through an unsettled territory, as with our Western roads, but through a country the industries of which were already established. Tracks led, not into prairies, but to populous cities; and the future of the company, once the initial difficulties should have been overcome, was at no2 time uncertain. Thus extension to Cumberland increased the gross receipts from $426,492 to $575,235, and that to Wheeling in 1853 likewise brought a great increase in traffic.

The Civil War bore upon the Baltimore & Ohio heavily because of the peculiar location of its mileage. On May 28, 1861, possession was taken by the Confederates of more than one hundred miles of the main stem, embracing chiefly the region between the Point of Rocks and Cumberland.4 Government protection was temporarily restored in 1862, but raids occurred until the end of the war. Each time the Confederates occupied the line they tore it up, and as soon as they retired the company hastened to make repairs. The road did not default. A portion of the track yielded a revenue from first to last, and presumably the Government paid generously for the transportation of its troops.

It was after the Civil War that the real history of the road began. The key-note was competition;—competition of the fiercest sort between parallel lines from Chicago to the seaboard, intensified by the rivalry of the great seaboard cities, and involving traffic in both directions. The decade 1850–60 had seen the extension of Eastern roads to Western connections. In 1851 the Erie had reached Lake Erie; in 1853 the New York Central and Lake Shore, and in 1855 the Pennsylvania and Fort Wayne had opened continuous routes from the Atlantic to Chicago. In 1857 the Baltimore & Ohio had obtained connection with Cincinnati and St. Louis; and in 1858 the Grand Trunk had arrived at Sarnia on its way from Portland to Chicago. After the Civil War there was both consolidation and extension. The New York Central was united with the Hudson River, and the Pennsylvania leased the Pittsburgh, Fort Wayne & Chicago in 1869. The Baltimore & Ohio reached Chicago in 1874, and the lines which in April, 1880, were consolidated into the Chicago & Grand Trunk were completed between Port Huron and Chicago in February of that year. The completion of these through routes opened the way for very bitter competition. Five independent lines struggled for Chicago business, and all of them were prepared to cut rates deeply in order to test their rivals’ strength. In particular the Baltimore & Ohio was aggressive. “At the time of its [Chicago branch] opening,” said Mr. Blanchard before the Hepburn3 Committee, “it was heralded all over the Northwest as a ‘Relief for the Farmer,’ ‘the Grangers’ Friend,’ and all other sorts of headlines were put into the Chicago and Northwestern papers; and President Garrett’s public utterances, and those to his Board, were filled with enough statements to show what he intended to do.... I heard him [say] that upon the completion of his lines, like another Samson, he could pull down the temple of rates upon the heads of these other trunk lines.”5

Under these circumstances a dispute between the Baltimore & Ohio and the Pennsylvania in 1874 over the former’s connection with New York had far-reaching consequences.6 The Pennsylvania refused to carry Baltimore & Ohio cars over its line north from Philadelphia, and as a retaliatory measure the Baltimore & Ohio reduced passenger fares from Washington and Baltimore to Western points from 25 to 40 per cent.7 The reduction in rates thus begun inaugurated the first of the great railroad wars. The cuts soon extended to east-bound passengers and to freight, and forced corresponding cuts on the Pennsylvania, the Lake Shore & Michigan Southern, the Michigan Central, the New York Central, and the Erie. Rates on fourth class and grain from Chicago to New York, which had been 60 cents per 100 pounds in December, 1873, and 40 cents in December, 1874, fell to 30 cents in March, 1875. Rates on special, or sixth class,8 went as low as 12 cents from Baltimore4 and Philadelphia to Chicago. Passenger fares from Chicago to Baltimore and Washington were reduced from $19 to $9, to Philadelphia from $19 to $12, to New York from $22 to $15, and to Boston from $22 to $15. The New York Central and the Erie quoted fares from New York to Chicago of $18 and to St. Louis of $20, and the Baltimore & Ohio replied by a cut to $16.25 to Chicago. In April, 1875, the Baltimore & Ohio cut freight rates from Cumberland to Baltimore over 50 per cent on the four regular classes, and the Pennsylvania at once announced still greater reductions.9

The effect of this warfare on railroad revenues was sufficiently serious to cause the Baltimore & Ohio to recede somewhat from its independent position and to enter into negotiations with the Pennsylvania;10 but the terms of the resulting agreement proved unsatisfactory to the other trunk lines, and no general pacification was obtained. Late in 1875 rates nevertheless generally advanced, and in December a general agreement was concluded, followed by a general increase. This agreement was again hopelessly disrupted by the following April, when cuts in east-bound rates followed each other with rapidity. The published rates on grain, which had been 45 cents at the beginning of March, 1876, fell to 40 cents on March 7, 35 cents on April 13, 22½ cents on April 25, and 20 cents on May 5. In June rates on west-bound freight fell to 25 cents first class to Chicago, and 16 cents fourth and fifth class, actual rates going5 much lower; and it was possible to travel from New York to Chicago first class for $13.11

Warfare between railroads became intensified by the competition between the cities which the railroads served, and by 1876 the question of relative rates to New York, Philadelphia, and Baltimore had grown to be of primary importance.12 By an agreement in 1869 Baltimore had been given a differential on east-bound freight of 10 cents per 100 pounds, which had been reduced to 5 cents on grain in 1870. On west-bound freight Baltimore had enjoyed a differential in 1875 which had ranged from 10 cents on first class to 5 cents on special class freight, and Philadelphia one which had been 2 cents less except on first class, where the Philadelphia differential had been 3 cents less than that to Baltimore. A temporary agreement of March, 1876, had replaced these allowances by differentials of 13 per cent in favor of Baltimore and 10 per cent in favor of Philadelphia as against New York. This relation was fought over in the rate war of 1876. In December of that year another agreement was reached on the basis of equal rates from Western points to Europe on export traffic via all four competing seaboard cities, and reduced percentage differentials on local traffic to those cities; but this proved temporary, the subsequent advances in rates were not general, and final agreement was not secured until April, 1877. The contract then executed was in the nature of a compromise. The differential to Baltimore was reduced from 13 per cent to 3 cents, and from Philadelphia from 10 per cent to 2 cents, to apply equally to local and to export traffic. Rates to Boston were at no time to be less than those to New York. Differentials on west-bound traffic were to be the same as those on east-bound on third class, fourth class, and special freight, and on first and second classes to be 8 cents less per hundred from Baltimore and 6 cents less from Philadelphia than from New York.13

6 The years following the agreement of 1877 were marked by low and fluctuating rates, extensive cutting under the published schedules, and frequent attempts at pooling and at apportionment of traffic. At a meeting at Chicago on December 19, 1878, tariff rates were agreed upon by all lines, but the existence of time contracts depressed receipts for months thereafter. Another meeting on May 8 was followed by sharp competition. In June an agreement to raise rates was made, but proved unsatisfactory owing to long time contracts. “During the period between December 18, 1878, and July 5, 1879,” said Mr. King in a letter to the Trunk-Line Arbitrators on July 17, 1879, “the Baltimore & Ohio Company has practically been out of the market, on account of the low rates by the Northern lines. It has not secured enough east-bound freight to give return loads for the small west-bound traffic sent over its lines to that city, and has repeatedly moved its cars empty from Chicago to other points on its lines east of that city.”14

Early in 1881 the cutting of rates became sufficiently important to force official recognition by the chairman of the trunk-line pool.15 By June 17 quoted rates on grain were 15 cents per 100 pounds from Chicago to New York, and a railroad war was in full swing.16 By October the grain rate had been reduced from 15 cents to 12½ cents; by August passenger fares were $7 from New York to Chicago, and $16 from Chicago to New York, and there was quoted besides a $5 Boston to Chicago rate over the Grand Trunk. The radical nature of these cuts can be appreciated from Mr. Albert Fink’s7 testimony before the Hepburn and Cullom Committees. Fifteen cents, said he in 1879, just covered the actual cost of hauling the grain;17 twenty cents, he asserted in 1885, was the bare cost of movement, including the general expenses, but without any profit to the road.18 Grain was therefore not repaying the specific cost of hauling, and passengers were obviously in similar case. Temporary relief occurred through the large increase in business which took place at the end of 1881. In October the Pennsylvania and the Baltimore & Ohio advanced east-bound rates because of the abundance of traffic offering, and the New York Central, Erie, and Grand Trunk followed to a less degree. In November further advances occurred, though west-bound rates remained low; but throughout December and January rates were low and fluctuating,19 and negotiations were carried on for the settlement of the differential question which underlay the trouble. None of the combatants were open to conviction; the only outlet was therefore arbitration, and this was reluctantly resorted to.20 In January, 1882, the roads divided the through trunk-line business, agreed to raise rates, and left the subject of differentials to be investigated by Messrs. Thurman, Washburn, and Cooley.21

This solution settled nothing. During the following three years constant disputes arose over the proper division of traffic,22 and in 1884 the old struggle was resumed with unabated vigor. Rates on grain to the seaboard fell from 30 cents to 20 cents on March 14 of that year, and to 15 cents on March 21; remaining low and8 fluctuating through the year.23 Immigrant business from New York to Chicago was handled by the Pennsylvania at one dollar a head. By February, 1885, rates for traffic in both directions were completely demoralized. Nominal east-bound charges on grain were 25 cents, or a 10 cent advance since the preceding March, but actual rates were as low as 8 and 10 cents. Meanwhile published rates on west-bound freight were a third less than the standard tariff, and passenger rates in both directions were, roughly, one-half the regular charges. The following month still further reductions occurred. The warfare was finally terminated by an agreement to maintain rates late in 1885,24 followed by an elaborate pooling agreement between the competing lines.25

From 1875 to 1885 the trunk lines to the Atlantic ports were thus engaged in active competition. What was the effect of this upon the Baltimore & Ohio? This road was highly prosperous in 1875. Dividends of 6 per cent and 10 per cent were being paid. The capitalization was small, and the management conservative. During the ten years following 1875 the rate of dividend was not materially decreased. In 1876 10 per cent was paid. In 1877 the old 8 per cent rate was restored, and the following year the distribution was made in stock instead of in cash. After the agreement of 1878 one-half year’s dividend was paid in cash; and in 1879 9 per cent cash, and in 1880 10 per cent cash was declared, this rate enduring until 1886. But although dividends were maintained, the effect of the railroad wars appeared in the slowness with which net earnings increased. A comparison of the net returns of 1884 with those of 1874 reveals a gain of 40 per cent, on a mileage 27 per cent greater; but the figures for 1885 show an increase of less than 2 per cent over those for 1874, while the totals for 1884 were not again equalled until 1900. Meanwhile more bonds had been issued, and the percentage of fixed charges to net earnings had increased from 16 in 1874 to 63 in 1884. In other words, money was borrowed to put into the road which did little more than keep the net earnings from9 declining. In that same time the stock increased $2,900,000, and according to the profit and loss account $15,559,636 were put into the property, making a total of $55,743,092 (of this $37,197,696 were bonds); the only result of which was the building of 313 miles of line, and the securing of an increase in net earnings for 1884, which was swept away the following year.

In 1884 the elder Garrett died, and his son Robert was elected to succeed him. The old policy of independence and competition was continued, the objective point being now an entrance into New York. “When in 1885 the other trunk lines harmonized their differences, ...” said the Chronicle, “the Baltimore & Ohio ... pursued its policy of aggression.... The road must reach Philadelphia ... nay, must push ... on to New York.... Instead of seeking to avoid rivalry, its every effort seemed to encourage it. Rates were reduced, concessions made to shippers and travellers, the one idea apparently being to get traffic no matter what the cost.”26 The necessity of a secure New York connection had been impressed upon the company in the course of the rate wars. The first step was to be actual construction to Philadelphia, the second, construction or traffic agreements from Philadelphia to New York. Bonds were issued in April, 1883, for construction of a so-called Philadelphia branch from Baltimore to the northern boundary of Cecil County, Maryland,27 there to connect with the Baltimore & Philadelphia Railroad, which was being built through Delaware and Pennsylvania to Philadelphia. Entrance into Philadelphia was secured over the Schuylkill River East Side Railway, a corporation organized under the laws of Pennsylvania and doing business in the city only.28 The distance was approximately ninety-nine miles; the cost was later asserted to have been $20,000,000. Beyond Philadelphia the Baltimore & Ohio relied on an agreement with the Philadelphia & Reading for trackage to Bound Brook, New Jersey,29 and on a traffic contract with the Central of New Jersey for its line from Bound Brook to Elizabeth.30 Terminals10 on Staten Island were secured by purchase of a controlling interest in the Staten Island Rapid Transit Company,31 and connection between Elizabeth and the Island was obtained by new construction. The strength of this route was in its directness and in its independence of trunk-line control; its weakness was in its excessive cost between Baltimore and Philadelphia, and in its reliance upon traffic contracts north of the latter city. A proposition was advanced to unite the Baltimore & Ohio, the Philadelphia & Reading, and the Central of New Jersey with the Richmond Terminal System. This, however, fell through,32 and the possibility still existed that the Baltimore & Ohio might some day construct a line of its own from Philadelphia to New York.

Pending the completion of the preceding arrangements rate conditions remained naturally unsatisfactory. The Pennsylvania objected to the paralleling of its Philadelphia-New York branch, and refused to allow temporary use of that line by the Baltimore & Ohio while the latter’s independent connections were being established.33 Freight rates were slowly and painfully raised after the conflict of 1884–5, and did not regain a high level. In 1886 the Baltimore & Ohio was forced to reduce its dividends from 10 to 8 per cent. The following year it cut to 4 per cent, and in 1888 no dividend at all was declared. The surplus on the year’s operations, which had not since 1878 fallen below $1,000,000, dropped to $110,819 in 1885, and to $36,259 in 1886. As dividends decreased, the funded debt increased,34 the percentage of fixed charges to net income rose from 63 to 89, and the floating debt attained the portentous amount of11 $11,148,007. The only item which did not grow was net earnings. There was nothing occult in the situation. Every one was well aware that the competition to which the Baltimore & Ohio had been subjected had been severe, and that the cost of its New York extension had been large. In 1887 the bonds outstanding were $56,868,201, the stock $19,792,566, and the accumulated surplus $48,083,720, or a total of $124,744,487. This stood for the sums invested in the property. Net income on the other hand was $4,994,721; so that on an investment of over $100,000,000 but 4 per cent was being obtained to cover interest, improvements, and whatever dividend might be declared.

That no general apprehension was felt by investors before 1887 was due to the great prestige which the Baltimore & Ohio enjoyed. The long series of dividends counted heavily in favor of the road. The enormous accumulated surplus, said to have been invested in valuable improvements and extensions;35 the enterprise of the company in making extensions; the large volume of business; and the confident statements of the president, all conspired to prevent a too keen analysis of the business returns.36 Relief of two sorts was nevertheless required. In the first place the floating debt had grown so large that some means of paying it off was necessary; in the second place the road needed a sufficient reduction in fixed charges to restore some of the margin of non-mortgaged earnings which had been so great a safeguard in the early days. Only the first of these requirements was met. Cash the road had to have; the existing fixed charges, it was thought, it could endure if only some abatement of the intensity of trunk-line competition could be obtained.

The method chosen for raising cash was the sale of bonds. In September, 1887, J. P. Morgan & Co. announced that a preliminary contract had been entered into between the Baltimore & Ohio Railroad Company and J. S. Morgan & Co., Baring Bros. & Co., and Brown, Shipley & Co., of London, and their allied houses in America, for the negotiation of $5,000,000 Baltimore & Ohio Consolidated12 5s and of $5,000,000 preferred stock, for the purpose of paying off the entire floating debt, and of placing the company upon a sound financial basis.37 The consolidated bonds were to be part of an authorized issue of $29,600,000, of which $21,423,000 were to be reserved to retire the main stem mortgage indebtedness when it should fall due, and $8,177,112 were to be exchanged for securities in the company’s sinking fund, the freed securities to be used to pay the floating debt in part. In case this exchange should not be made, $7,500,000 of the issue might be sold direct, and the syndicate before mentioned agreed to take $5,000,000 of this amount and to place $5,000,000 in preferred stock on condition:

(a) That the statements of the company should be verified;

(b) That the management of the company should be placed in competent hands, satisfactory to the syndicate;

(c) That satisfactory contracts should be made between the Baltimore & Ohio and other roads for New York business, which should remove all antagonism between them on the subject, and should ensure the permanent working of the first-named in entire harmony with the other trunk lines, besides avoiding the construction, or the threat of construction, of expensive lines north and east of Philadelphia.

Annual payments to the Baltimore & Ohio sinking funds were to be made in the future in consols instead of in cash.38

The essence of this arrangement was a funding of the floating debt, plus agreements with other roads in order to maintain earnings. The funding involved, however, a certain increase of charges through the issue of bonds, while the agreements offered but a doubtful chance of increased earnings. Only by an effective community of interest or of ownership among the trunk lines could a saving have been secured on which the new bond issues could safely have relied. That this was to take place through the syndicate, that body was emphatic in denying. “The statement,” said Vice-13President Spencer, “that the Baltimore & Ohio Railroad has passed into the hands of a syndicate, of which J. P. Morgan is the head, is absolutely without foundation.... The syndicate has the greatest interest now in the growth of the Baltimore & Ohio, and to secure this growth and progress absolute independence of other corporate predominance is essential, and the road must be worked in the interest of the states and territories it reaches.”39 This declaration left only informal agreements as a resort; for pooling had been forbidden in 1887. It did more, it implied the necessity of a maintenance of competition, for to work the Baltimore & Ohio in the interest of Baltimore meant to work it against the interest of New York. In principle the plan was nevertheless adopted. Bondholders saw no necessity for a radical reorganization, and were willing to consent only to a new issue of bonds. Certain modifications were, however, imposed. The exchange of new bonds for securities in the sinking fund was abandoned, and the alternative of direct sale was embraced. It was found impossible to secure the consent of stockholders to an increase in the preferred stock, three attempts to obtain the required authorization failing in the week ending January 20, 1888.40 Furthermore, the failure of the stock issue led President Spencer41 to request that the city of Baltimore extend for five years at 4 per cent a $5,000,000 loan to the company, which was to mature in two years, and that it return the sinking fund of $2,400,000 which had accumulated in its hands for the eventual cancellation of the debt.42 It may be added that this suggestion was not accepted.

14 While awaiting final settlement of the syndicate scheme the Baltimore & Ohio obtained some cash from the disposal of all its free resources; that is, from the telegraph, express, and sleeping-car businesses which it had conducted since early in the administration of John Garrett. In August, 1887, it sold its express business to the United States Express Company for a period of thirty years, in return for $1,500,000 of the capital stock of the express company plus a certain percentage of the annual earnings of the express lines handed over.43 In October of the same year its telegraph business was turned over to the Western Union Telegraph Company in return for $5,000,000 of the Western Union stock, and an annual payment of $60,000 in cash.44 Finally, in June, 1888, its sleeping-car equipment and franchises were transferred to the Pullman Company for a period of twenty-five years at a reported price of $1,250,000.45 The company agreed to furnish all the sleeping and parlor cars required. This brought the incidental advantage of ending long-continued suits over patents. The terms of sale to the telegraph and express companies brought in no ready money, but the securities obtained were readily salable, and being independent for their value of the commercial success of the Baltimore & Ohio were available for times of difficulty. It was this policy which offset the refusal of the city of Baltimore to return the sinking fund to the company, and which by March, 1888, rendered the road even to some extent independent of the syndicate. At that date a modification of the syndicate agreement took place. The bankers gave up all claim to the $5,000,000 of stock so long under discussion, and took instead the balance ($2,500,000) of the $7,500,000 consolidated mortgage bonds which the company was authorized to sell. “The syndicate acted,” said the Baltimore Sun, “in an entirely friendly spirit, and,15 with a desire to continue its financial relations with the company, took the remaining $2,500,000 ... at a better price than was paid for the $5,000,000.”46

With temporary financial requirements provided for, President Spencer was enabled to achieve some much-needed reforms. At a meeting of the directors on March 14 a complete reorganization of the service was authorized, with changes and transfers affecting employees from the first vice-president down. Later a committee of mechanical experts was organized “to examine thoroughly all the shops, shop tools, etc., of the entire Baltimore & Ohio system, and to report on all the improvements needed.”47 The form of the annual report was improved. The much-quoted surplus, which had proved such an unreliable support, was cut in two by the writing off of bad investments, the marking down of the price of securities, and the like; and, finally, a committee was appointed to make a general examination of the financial as well as the physical condition of affairs.48 “Great anxiety,” said a resolution of the directors, “exists in the public mind as to the financial condition and the value and earning capacity of the road and property ... [and] it is due to all interests that a full, frank, and complete statement of its affairs should be made public.” So far as lay in his power President Spencer, and through him the syndicate, tried to secure a real and permanent improvement in the condition of the road, and to gain, through increased efficiency in operation, the margin which the refusal to cut down fixed charges had denied. The failure of the attempt may be ascribed to the continuance of the Garrett family in power. Any irregularities or mistakes which had taken place in the past reflected on the Garretts, so that it was to their interest to stifle investigation. Moreover, any change in policy for the future implied a criticism of their acts to which they were reluctant to accede. In 1888 the Garrett holdings amounted to from 50,00016 to 60,000 shares out of a total of 150,000 shares, or, deducting 32,500 shares held by the city of Baltimore, which were not entitled to vote, to about one-half of a total of 117,500 shares. This gave undisputed control. The effect was seen in the annual election in November. Of 12 old members of the board only 5 were reëlected, and of the 7 dropped 3 formed part of the investigating committee engaged in securing “the full, frank, and complete statement of the company’s condition” promised at an earlier date.49 The same month President Spencer was ousted and Mr. Charles F. Mayer was elected in his place.

This revolution was fatal to any radical reform, so that during the next seven years the condition of the Baltimore & Ohio improved but little. Net income grew, it is true, up to the panic year of 1893, but fell so sharply after that that the reported figures for 1895 exceeded those of 1888 by but $1,283,843, and even this gain was practically wiped out during the following year. Meanwhile fixed charges grew from $6,550,972 in 1888 to $6,934,052 in 1895, and to $7,303,781 in 1896; an increase which transformed the profits of the company the following year into a deficit. A comparison of the balance-sheets of 1888 and 1895 shows an increase of $10,207,434 in stock, of $16,261,000 in funded debt, and of $4,554,939 in floating debt. These changes were offset mainly by increases in bonds and stock owned, or in the hands of trustees, by advances to subsidiary lines, and by a reduction of $11,080,000 in bonded debt secured by collateral or by mortgage on the main line. During this time dividends were nevertheless steadily paid on the preferred stock, and, beginning in 1891, upon the common stock as well. The liberal tendencies of the management were also evinced by a 20 per cent dividend upon the common stock, declared in 1891 to compensate shareholders for expenditures in betterments and improvements of the physical condition of the property.50 It will be17 seen how different this was from the policy of retrenchment and economy which had been inaugurated by President Spencer, and which might fairly have been expected from a corporation barely escaped from bankruptcy.

Traffic conditions from 1887 to 1893 were very far from satisfactory. The difficulties between the Baltimore & Ohio and the Pennsylvania were indeed patched up, and the opening of the former’s lines to New York rendered it independent of other trunk-line connections; but frequent charges of rate cutting were made in 1887, and a war in dressed-beef rates was inaugurated by the Grand Trunk in November of that year. In 1888 rates were pretty much demoralized. Published rates on grain dropped from 27½ cents in January to 20 cents in October. Emigrant rates from New York to western points became the subject of active competition; and, most important of all, the dressed-beef controversy was pushed till it developed into a war of the most active kind. The trouble here was started by cuts on dressed beef by the Grand Trunk. In May other lines retaliated by cuts in live-stock rates; by July 14 published rates on cattle from Chicago to New York were 5½ cents per 100 pounds, and on dressed beef and hogs 7 cents. In November the New York Central extended the contest by a general reduction in west-bound rates.51 These struggles, though terminated for a time by an agreement of February, 1889,52 seriously diminished railway revenues, and prevented the rapid growth which the general prosperity of the country might have occasioned.53 In fact, the Erie management stated in their annual report for 1888 that their company had retired altogether from certain classes of through18 business for a time during the preceding twelve months, owing to the unremunerative level of rates. Conditions during the greater part of 1889 were better,54 and during the following three years constant attempts at agreement and arbitration, joined with a considerable volume of business,55 prevented a long continuance of any difficulties which arose.

It was perhaps traffic conditions such as we have described which led the Garrett family to favor a community of interest scheme which should improve the Baltimore & Ohio connections with the West. In June, 1890, Mr. E. R. Bacon formed a syndicate to control the stock of the Baltimore & Ohio Company. Acting in harmony with the Garrett family, the syndicate was made up of Philadelphia, New York, Baltimore, and Pittsburg capitalists, including the Richmond Terminal, Pittsburgh & Western, Northern Pacific, and Reading interests. The plan was to establish a community of interest between a vast network of lines reaching from the Atlantic to the Pacific, and from New York to the Mississippi. “The buyers,” it was said, “came in simply as investors without condition that their other properties would be benefited, although it was of course intimated that something was to be done.”56 They were required to pool their stock for three years, and to give an irrevocable proxy for that period to President Charles F. Mayer. The amount of the syndicate purchase was 45,000 shares, of which 32,500 were obtained from the city of Baltimore, and 9686 (preferred) from the state of Maryland;57 and the purchase brought19 the incidental advantage of removing city and state from any direct interest in the road. The preferred state stock the syndicate later exchanged for common stock owned by the Johns Hopkins University. The purchase once made, the pool was formed on well-known lines. The stock was deposited with a trust company, trust certificates were issued, and proxies transferred to Charles F. Mayer.58 The shares to be deposited were limited in amount to 110,000; the actual amount put in was 89,750. The results of the agreement were less sensational than the forecasts made. It undoubtedly did much to promote friendly feeling among the roads concerned. When, in 1891, the Baltimore & Ohio was compelled to vacate the Chicago terminals of the Illinois Central, which it had occupied for years, it was able to make prompt arrangements with a corporation controlled by the Northern Pacific for the use of its facilities both for passengers and for freight. But the influence of the Garrett family was not lessened, and inasmuch as the main competitors of the Baltimore & Ohio were not included there was no check to competition, and earnings showed no striking change.

Matters stood thus at the beginning of 1893.59 No progress had been made toward restoring the Baltimore & Ohio to a permanently stable condition, and the prosperity which its reports declared was fictitious only. The reorganization to which bondholders had refused to submit in the comparatively prosperous times of 1888 was compelled by the depression following the panic of 1893. In 1894 earnings fell off. The gross earnings for the year ending June 30, 1893, were $26,214,807, and the net income $9,210,666; the following year the same items were $22,502,662 and $8,719,830. The directors reduced the dividend and called attention to the losses incurred through protracted strikes in the coal and coke industry.6020 The following January (1895) President Mayer stated that the fixed charges, including the car trusts, sinking funds, etc., due January 1, amounting to nearly $1,000,000, had been paid without borrowing one dollar. “I name this fact especially,” said he, “because it is not unusual for us to make a loan for the unusually heavy payments January 1. I doubt if the Baltimore & Ohio has owed so small a floating debt for twelve or fifteen years, perhaps longer, and it never had the large volume of stocks and bonds it now has, something over $16,000,000, not put down at their face value but rather at their market value, or far below their intrinsic value. I can safely say the road has not been in so strong a position as now for at least fifteen years.”61

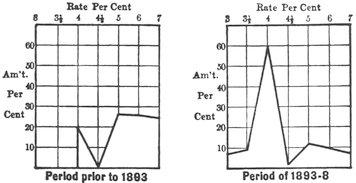

It required more than confident statements by the managers, however, to demonstrate the secure position of the road; and this all the more because the acts of these gentlemen belied their public assertions. Dividends on the common stock were passed in 1895, and again in 1896. The ratio of charges to earnings, according to the company’s reports, rose from 75 per cent of net earnings in 1894 to 80.2 per cent in 1895, and to 98.2 per cent in 1896; that is, less than 2 per cent of the net earnings of $6,300,000 was admitted to be available for dividends on $30,000,000 of stock.62 Some relief was evidently necessary. In January, 1896, it was announced that arrangements had been made with a strong syndicate to provide for all immediate financial requirements; but the appointment of receivers in February could scarcely have come as a surprise. During the two weeks just before the failure Mr. J. K. Cowen, who had succeeded Mr. Mayer in the presidency, spent a great deal of time in New York trying to borrow money to meet the21 pressing demands. On his eventual failure and return to Baltimore the directors felt that a friendly receivership was the only resource.63

To the well-wishers of the road this failure may have seemed an opportunity as well as a disaster. It was now possible to accomplish what the management in 1888 had refused to attempt, i. e. a reduction in the fixed charges of the company which should remove the burdens under which the road had labored, and should open up the way for a long period of improvement and prosperity. At least one more unpleasant experience was, however, to be passed through. With a view to determining the Baltimore & Ohio’s real position, an expert accountant, Mr. Stephen Little, had been set to work upon its books, and from time to time notices had been appearing that he was at work, that his examinations confirmed the statements of the company, and that questions raised by hostile critics would be considered in his report. Thus in April a reorganization committee, composed of Messrs. Alexander Shaw, C. Morton Stuart, and six others, with whom were deposited the Garrett shares, issued a circular referring to the large amount of new capital, estimated by them at $30,000,000, which had been received by the company since 1888 “without adequate or satisfactory results,” and to the floating debt, which they asserted had been increased from about $3,500,000 to $16,000,000. “We make no charges, or even intimations of wrongdoing,” wrote their secretary, “but desire and require that a full explanation of the management of the property from the year 1888, when the road was set on its feet by Mr. Morgan, shall be given, and that the causes which led to the wrecking of the property shall be clearly shown.” To which another committee, which directly represented the management, replied by reference to Mr. Little.64

The much-heralded report came out in December, having been withheld since the previous March for fear of the effect on the company’s securities; and so far from sustaining the management, it contained charges of irregularity almost as sensational as those made against the Atchison at an earlier date. The books of the company, according to Mr. Little, were in error to the amount of22 $11,204,858. During the period of seven years and two months which his report covered he found:

| An overstatement of net income of | $2,721,068 | |

| A mischarge of worn-out equipment to profit and loss of | 2,843,596 | |

| Improper capitalization of charges to income under the head of construction, main stem, | 2,064,741 | |

| Improper capitalization of so-called improvements and betterments of leased and dependent roads, | 3,575,453 | |

| Total, | $11,204,85865 |

Deducting these sums from the annual income returns of the company, he found that but $971,447 had been earned which had been properly applicable to dividends, whereas $6,269,008 had been declared in the seven years, of which $3,312,089 were cash and $2,956,920 stock. Earnings had been increased by the most arbitrary of book-keeping devices. In 1892 the value of the Western Union stock held in the treasury since the sale of the Baltimore & Ohio telegraph lines in 1888 had been written up $468,038, and the stock of another company, the Consolidated Coal Company, had been written up $114,300. Not only had advances to branch lines been entered as assets, but the interest on these advances had been credited to income, the only basis being that it was hoped that such interest would some day be paid; and on the other side of the account, charges against operating expenses had been charged to profit and loss on the same principles by which the Garretts had rolled up their fictitious surplus of 1888. Turning to the capital account, Mr. Little showed an increase in liabilities from 1888 to 1895 of $22,180,000, not including $5,481,835 representing chiefly the company’s endorsements of notes of its subsidiary roads which stood here for the first time revealed. This money apparently had been put into the property, and yet Mr. Little’s corrected figures showed net earnings to be actually smaller in 1895 than in the earlier years. Criticisms of the report attached themselves mainly to the last items treated. That the extensive endorsement of branch-line notes, absent as any mention of the practice was from the annual reports, was most misleading and unsound, nobody could deny;23 but the broad question of what charges during the seven years should have been paid out of income, and what not, gave rise to lively discussion. Severe strictures on Mr. Little’s statements were made by Patterson and Corwin, two accountants appointed to re-examine the books of the company. “It would appear,” said they, “that Mr. Little has made some curious errors, and has been strikingly inconsistent.”66 Nevertheless the more damaging of the latter’s accusations seem to have been accepted, and the Baltimore & Ohio took its place with other American corporations, the managements of which have indulged in secret juggling with the books.

Pending Mr. Little’s report, reorganization was of course delayed. The receivers were then in control,67 and under their direction a vigorous policy of improvement was carried out. The rolling stock of the system was found to be insufficient to handle its business, and the motive power was in similar condition. All testified to the consistent desire of the old management to employ every device which might contribute to greater apparent earnings. Contracts for 5000 freight cars were let as early as May, 1896, to be paid for in receivers’ certificates, and bids for 75 locomotives were at the same time received.68 During their whole administration the receivers purchased over 28,000 freight cars, 216 locomotives, 123,000 tons of rails, besides ties, ballast, new steel bridges, and miscellaneous improvements of various sorts.69 On the financial side they had to resist an attempt to compel payment of dividends on the preferred stock. The case dragged on through 1897 and 1898, and was finally decided in favor of the company.70

After the publication of Mr. Little’s report there remained no serious bar to reorganization, while the needs to be met were more apparent than ever before. If the proportion of charges to earnings24 had been too heavy on the management’s own showing, how much more burdensome was it when the reported earnings had been proved too high, and the reported liabilities too low! The first step after the appointment of receivers had been the springing up of reorganization committees. The two most prominent were the Fitzgerald Committee, representing the directors, and the Baltimore Committee. There were besides committees representing the 5 per cent bonds of the loan of 1885, the consolidated mortgage 5s, the 6 per cent bonds of 1874, the preferred stock, and others. These were all to some extent antagonistic. It was hoped to secure a reorganization without foreclosure, but to provide against all contingencies a bill was introduced and passed through the Maryland legislature, permitting a new company to succeed, after reorganization, to the property of the Baltimore & Ohio system.

By April, 1898, a reorganization plan was ready, and was withheld only on account, first of the threatened, and then of the actual, war with Spain. Two months later this difficulty seemed no longer serious, and a plan was formally announced.71 There were contemplated two great issues of bonds and two of stock as follows:

| 3½ per cent prior lien gold bonds, | $70,000,000 | |

| 4 per cent first mortgage gold bonds, | 50,000,000 | |

| 4 per cent non-cumulative preferred stock, | 35,000,000 | |

| Common stock, | 35,000,000 |

These were to be parts of larger amounts authorized but not issued. Thus the authorized amount of prior liens was $75,000,000, of which $5,000,000 were to be reserved, and to be issued after January 1, 1902, at the rate of not exceeding $1,000,000 a year, for enlargement, betterment, or extension of properties covered by the prior lien mortgage; or for the acquisition of additions thereto.72 The authorized amount of first mortgage 4s was $165,000,000. Since the prior liens matured in 1925, and this mortgage not till 1948, $75,000,000 were reserved for retirement of the prior issue. $7,000,000 were25 further put aside for the new company; $6,000,000 for the retirement of the Baltimore Belt Line 5s, and $27,000,000 for enlargements, betterments, or extensions, etc., at a rate not exceeding $1,500,000 a year for four years, and not exceeding $1,000,000 a year thereafter.73 The reserves from these two mortgages, therefore, made liberal provision for new capital requirements. All of the common stock authorized was to be issued at once; but besides the $35,000,000 preferred stock before mentioned, $5,000,000 preferred were to be held in reserve for the new company.

Of the immediate issues $60,073,090 prior liens, $36,384,535 first mortgage 4s, $17,218,700 preferred stock, and $31,178,000 common stock went toward the retirement of old securities; and $9,000,000 prior liens, $12,450,000 first mortgage 4s, and $16,450,000 preferred stock were for cash requirements. The better of the old mortgages received cash for their overdue interest, something over par in prior liens for their principal, and from 12½ to 32 per cent in first mortgage 4s and preferred stock to compensate for reductions in their annual return. Inferior bonds received new first mortgage 4s with preferred stock (except in one instance) as a douceur. The old stock, common and preferred, and the Washington City & Point Lookout 6s got mostly new stock for the principal of their holdings, and preferred stock for their assessments. The fundamental principle on which the exchanges were based was the retirement of old bonds bearing high interest rates by an increased volume of new bonds bearing lower rates; thus permitting a much smaller reduction in fixed charges than occurred in other reorganizations which we shall consider. To some extent reductions in annual yield were made up by allowance of preferred stock. The consolidated mortgage 5s of 1887, on which interest was reduced from $50 annually to $41.75, received $85 in 4 per cent preferred stock as a26 compensation. The Baltimore & Ohio Loan of 1874 saw a reduction in interest from $60 to $40.41, partially made up from the dividends on $160 of new preferred stock. In fact, out of thirteen cases in which new bonds were given for old, ten included an allowance of preferred stock, thus bringing the Baltimore & Ohio in line with other reorganizations of the period. But the proportion of preferred stock given was small in each case, and the principle was not well carried out.74

The cash requirements of the system were estimated at $36,092,500; being swelled by arrears of interest, receivers’ certificates, need for working capital, reorganization expenditures, and the like. The plan proposed to cancel them by assessments on stockholders and by the sale of securities before described. On the first preferred stock, $2 a share was levied, $20 on the second preferred, and $20 on the common stock, with a syndicate guarantee for each. This netted $5,460,000. Stockholders received new preferred stock for their payments. Deducting $5,460,000 preferred stock from the securities reserved under the plan to be sold for cash, there remained $9,000,000 prior liens, $12,450,000 first mortgage 4s, and $10,990,000 preferred stock, or a total of $32,440,000; all of which a syndicate agreed to take.75 In addition the company disposed of securities27 in the treasury, including $3,800,000 stock of the Western Union Telegraph Company, for $3,500,000.76

Both classes of stock were vested in five voting trustees, for a period of five years. The trustees might, however, deliver the stock at an earlier date in their discretion, and in fact did so in August, 1901. No additional mortgage was to be put upon the property, and no increase in the amount of the preferred stock was to be made, except in each instance after obtaining the consent of the holders of a majority of the whole amount of preferred stock outstanding, given at a meeting of the stockholders called for that purpose, and the consent of the holders of a majority of such part of the common stock as should be represented at such meeting, the holders of each class of stock voting separately. During the existence of the voting trust similar consent of holders of like amounts of the respective classes of trust certificates was to be necessary for the purposes indicated. Only a portion of the leased and dependent lines were provided for in the plan, but the various cases were left to be passed on separately. Thus the Baltimore Belt Line was finally leased at a rental equivalent to 4 per cent on the outstanding 5 per cent bonds; while the acquisition of the Baltimore & Ohio Southwestern and the Central Ohio railroads involved the payment of a cash bonus, and an increase in the preferred and common stock outstanding. The mileage of the system suffered little change. Many of the branches were sold at foreclosure, and bought in by the parent line; and a glance at the balance-sheet in 1899 shows that besides the prior liens and the first 4s, an issue of Pittsburg Junction and Middle Division bonds was the principal tool employed. These securities, bearing 3½ per cent, and falling due in 1925, were issued; 1st, to retire branch-line securities, and to weld the system into one united whole; and 2d, to provide new capital for enlargement and betterment and extension.

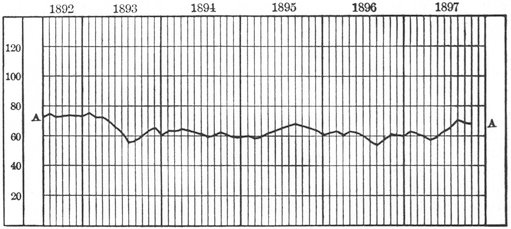

The success of this Baltimore & Ohio reorganization plan was very largely due to the time at which it was put through. In other words, the reorganization was completed just when an unparalleled28 era of prosperity was fairly under way. The moderate reduction in fixed charges which it secured proved more than adequate when earnings rapidly grew. The net earnings of the property for the year ending June 30, 1898, were estimated at $7,724,758, and the new fixed charges were set at $6,252,351.77 Net earnings for 1899 were $6,621,599. In 1900, on a mileage 11 per cent greater, they were $12,359,443, and fixed charges were $6,831,463 only. In subsequent years, with an increase both in mileage and in earnings, the margin between charges and income further increased. In 1903 $3,500,000 were spent out of earnings for additions and improvements; $7,370,482 were declared in dividends; and $2,947,681 were carried to surplus. In 1907 $3,000,000 were spent in additions and improvements, $6,965,245 paid in dividends, $7,480,385 carried to surplus. This situation was in no way due to the reorganization plan, and would have restored the company to solvency even if no reorganization had taken place. It may be said that the receivership did much to enable the road to take advantage of the later prosperity. The character of the receivers’ work has been mentioned. By June 30, 1899, they had spent as much as $17,000,000 for cars alone, $2,500,000 for locomotives, $2,100,000 for rails, and other sums for improvements and renewals of all kinds. The maintenance of way pay-rolls in three years amounted to nearly $12,000,000, and the total expenditure aggregated about $35,000,000; of which $15,000,000 were secured by the issue of receivers’ certificates, and the balance through car trusts, earnings from the property, and from the reorganization managers.78 This was an indispensable and invaluable preliminary to a growth in earnings, but was, however, distinct from the financial problems of reorganization. In brief, the Baltimore & Ohio increased its nominal capitalization more, and reduced its fixed charges less than any of the seven other reorganizations of the nineties which we shall consider except the Erie. Its need was perhaps less crying, but not sufficiently so to explain the difference.

It will be remembered that, while provision had early been made for foreclosure, it had been hoped to avoid such a drastic step. Hopes in this respect were fulfilled, and while a number of branch lines were29 sold the main stem escaped. Vigorous objections to the plan came from the preferred stock, which was in 1898 suing to compel payment of its dividends. In July, at a meeting of shareholders it was declared to be the sense of the meeting that the preferred stock could not justly be required to determine whether it would accept the proposition published by the reorganization committee before the case in the Supreme Court should be decided.79 Late in July an injunction was obtained, which, however, was dissolved in October. Still later in that year the suits were settled by the sale of the bulk of the first preferred stock to the reorganization committee.80 The only other considerable complaint came from the holders of the 4½ per cent Baltimore & Ohio Terminal bonds, and was a protest against the reduction of ½ per cent in their interest without, as they said, the smallest compensation. Suits for the foreclosure of the mortgages of 1887, 1872, and 1874 were instituted in October, 1898. Decrees were obtained in February. Decrees were also given against the Philadelphia Division, the Parkersburg Branch, the Staten Island Rapid Transit Company, and others. Separate receivers had previously been appointed for the Sandusky, Mansfield & Newark, the Central Ohio, the Washington Branch, and others. Decrees were not asked for against the main line. In August, 1898, only three months after the publication of the plan, the reorganization managers were able to pronounce it effective.

The receivers surrendered control July 1, 1899,81 and the company started on its new career amid a buzz of satisfaction from all who had participated in its reorganization. In an address before the Maryland Bar Association Mr. John K. Cowen summarized the result as follows:

(1) Every bondholder of the Baltimore & Ohio Railroad has received new securities which substantially pay his full debt. In other words, the bondholders have been paid in full.

(2) The floating debt creditors have received every cent of their indebtedness.

(3) The first preferred stockholders have received in cash 75 per cent of the par value of their stock, the court overruling their claim of preference over the bondholders and creditors. The second preferred stockholders have received securities which, after payment30 of the assessment, net about $70 per share, at the market price, and at times over $80 net could have been realized.

(4) The common stockholders, instead of being wiped out, have received their common stock in the new company upon paying an assessment, the net amount of which (because of the value of the securities received for such assessment) would not exceed $5 or $6.

(5) The company saves its old charter for whatever value may be attached to it.82

This statement presents the favorable side of the picture. On the whole, securityholders were tenderly handled, though the bondholders were by no means paid off in full. And on the other hand, this very tenderness made a voluntary reorganization possible, whereby the charter of the company was saved. The pertinent objections were from the point of view of the company itself, and these were silenced by the increase in earnings.

Since reorganization the Baltimore & Ohio has been enjoying great prosperity. On a mileage operated, which was some 1800 miles greater in 1907 than in 1900,83 it earned a return increased by over $40,000,000; while its income from dividends and interest mounted from less than half a million to over $3,000,000. Ton mileage figures were about 11,300,000,000 in 1907 as against 6,800,000,000 in 1900; passenger mileage had grown from 459,000,000 to 723,000,000. This prosperity has but reflected the condition of the country at large, but the Baltimore & Ohio has taken advantage of it in far-sighted fashion. No less than $17,000,000 have been spent from earnings for additions and improvements between June 30, 1899, and June 30, 1907, not to mention maintenance of way expenditures which have ranged from about $1500 to over $2500 per mile of road operated. Besides the provision made by the reorganization plan, $15,000,000 convertible debentures were issued under date of March 1, 1901, for new construction and improvements. There were authorized $40,000,000 of common stock in November, 1901, to go in part for improvements, and the bulk of $27,750,000 new common stock of 1906 will be applied to similar ends. As a result the company’s equipment has largely increased, grades have been reduced, curves straightened, light31 rails replaced by heavy, and subsidiary track increased. There were two miles of second, third, and fourth track and sidings for every three miles of main track in 1900; there were three miles to every four in 1907. A considerable increase in average freight train load has accordingly occurred. In 1900 the average load was 366 tons; in 1907 it was 433.02. That this figure has not still more greatly increased from the 406.53 tons of 1901 is probably due to the somewhat greater proportion of manufactures handled and to a considerable decrease in average distance hauled, and is compensated for by an increase of over one cent in the average rate received.

The events of most vital importance in the Baltimore & Ohio’s recent history have been connected with its control. In September, 1898, Philip D. Armour, Marshall Field, and Norman D. Ream, executors of the Pullman estate, together with James J. Hill of the Great Northern, bought a large interest in the stock, though whether or not sufficient to control no one knew. From statements by Mr. Cowen it would appear that the deal was somewhat similar to the earlier one in which the Northern Pacific had been interested: that is, it involved the sale of Baltimore & Ohio stock to secure the good will of men strong enough to support the road in case of difficulty, and influential enough to open desirable connections or to modify the stringency of competition. “The recent transaction,” said Mr. Cowen, “has been the realization of my hopes about the future of the road.” It was not Mr. Hill’s influence, however, that was destined to be dominant. By the end of the year rumors connected the Pennsylvania with the purchase of an interest in the property, and the election of Mr. S. M. Prevost, third vice-president of that company, to a directorship, gave assurance of the truth of the reports. It was, of course, impossible to purchase actual control so long as the Baltimore & Ohio stock remained in trust; but the trustees seemed very ready to accord to new buyers that representation and influence to which their stock might give them claim. At the annual election in November, 1900, an additional representative of the Pennsylvania was elected to the board, showing the probable increase of the Pennsylvania holdings, and the following year an absolute majority was said to have been passed, the shares held by Mr. Hill and his associates, and apparently sold to the32 Pennsylvania, being thought to contribute powerfully to that result.84 In May, Mr. Hill and Mr. Charles H. Tweed, chairman of the Southern Pacific, resigned from the directorate, to be replaced by two further representatives of the Pennsylvania. In June, President Cowen was replaced by Mr. S. F. Loree, fourth vice-president of the Pennsylvania lines west of Pittsburg, and in August the voting trust was dissolved.

The last step has been the sale of part of the Pennsylvania holdings to the Union Pacific system. It appears that the former’s interest in the company was largely due to anxiety over the coal situation. Before 1895 rates on bituminous coal had been depressed and demoralized. Rebates had been freely given in spite of any agreements which could be arranged. Under these circumstances the Pennsylvania had determined to buy enough stock of the Chesapeake & Ohio, the Baltimore & Ohio, and the Norfolk & Western companies to control the policies of these roads, and, through stock ownership in the Reading by the Baltimore & Ohio, to influence that company also.85 Unfortunately for the project public attention became concentrated on the coal industry at this time because of the discovery of certain flagrant abuses, and it seemed wise for the Pennsylvania to dispossess itself of a part of its stock.86 The Union Pacific was in the market with large resources derived from its sale of Great Northern and Northern Pacific stock. It was out of the question for the Pennsylvania to sell its shares to a competitor, but there was less objection to a sale to Mr. Harriman, providing a reasonable portion should be retained. Accordingly, the Pennsylvania sold and the Union Pacific interests bought, in33 October, 1906, some $39,540,600 in Baltimore & Ohio common and preferred stock, being in the neighborhood of half of the former’s holdings. This is the present situation of the property. The Baltimore & Ohio is independent, in the sense that it is not controlled by any single interest, but large amounts of its stock are owned by its competitor, the Pennsylvania, and by its connection, the Harriman system. On the whole the alliance with these interests augurs well for the future of the company.87

Early history—Reorganization—Wall Street struggles—Financial difficulties—Second reorganization—Development of coal business—Extension to Chicago—Grant & Ward—Financial readjustment—New York, Pennsylvania & Ohio—Third reorganization—Later history.

The New York & Erie Railroad was organized in 1833 in the hope of bringing to the southern tier of counties in New York State a prosperity equal to that which the Erie Canal had secured for the northern tier. It was to run from New York or some suitable point in its vicinity to Lake Erie. A six foot gauge was adopted, partly because the grades encountered were thought to require locomotives with more power than a narrower gauge could accommodate, and partly because it was wished to make the road independent of any connection which might lead trade away from the city of New York.88